Updated Information: Torch Lake FCU member vote was passed on March 26th.

Torch Lake Federal Credit Union and Peninsula Federal Credit Union announce their intent to merge for the benefit of members, employees and the communities they serve. Following completion of the merger, which is subject to approval from the Torch Lake Federal Credit Union’s members, the new credit union will have four branches across the Upper Peninsula & Northeast Wisconsin. The proposed merger, which is expected to be completed tentatively July 31st, 2025 has the unanimous approval of both the Torch Lake Federal Credit Union and the Peninsula Federal Credit Union Board of Directors and their respective leadership teams. In March, Torch Lake Federal Credit Union members voted and approved the merger with Peninsula Federal Credit Union.

Members will experience no immediate changes as the two organizations will operate independently until systems and processes are integrated and operational. Upon completion, the combined organization will operate under the Peninsula Federal Credit Union name. In recognition of the strong and proud histories of both Torch Lake Federal CU and Peninsula Federal CU, employees and members of both organizations will work together to develop a combined brand experience that honors both entities roots with a future-forward vision.

"Growth demands change and change requires courage; Torch Lake's founding members had the courage to offer our local communities a new way of "banking" in 1955 and now our membership has the opportunity to expand their financial opportunities by becoming Stronger Together with Peninsula Federal Credit Union."

-Connie Mikkola, CEO of Torch Lake Federal Credit Union

"We are excited for the opportunity to earn your trust and to become your financial partner. We will strive to provide you with the best products and services possible."

-James Veneskey, President & CEO of Peninsula Federal Credit Union

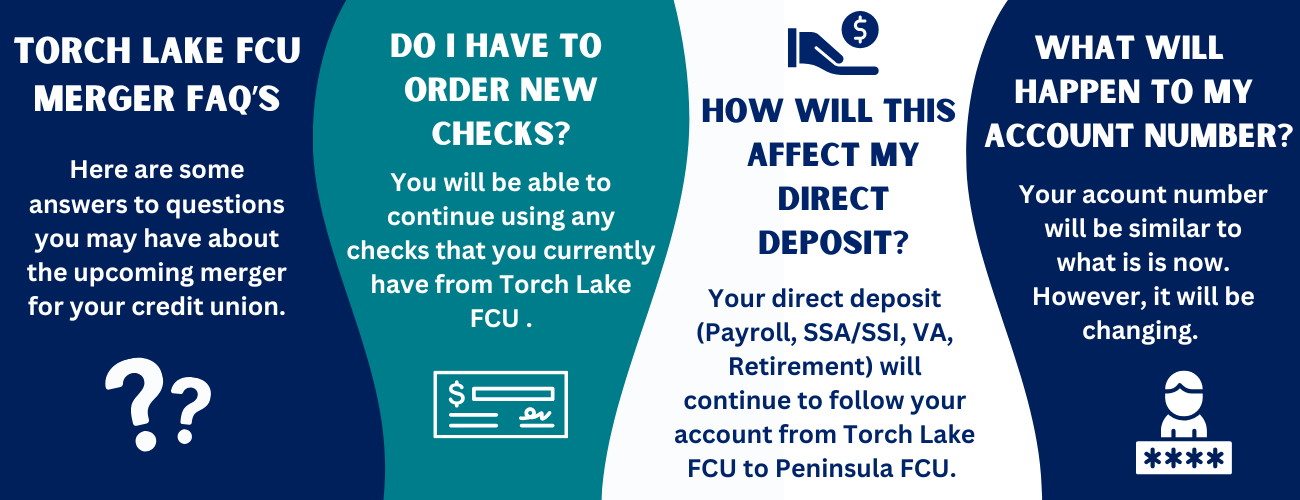

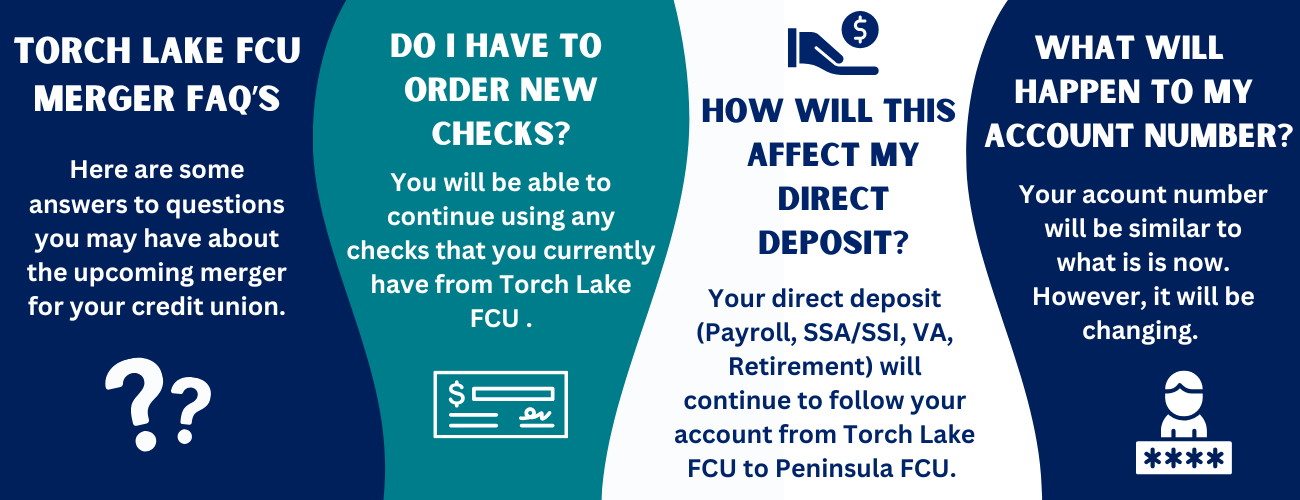

FAQs

This exciting announcement means that Torch Lake Federal Credit Union is moving forward with a proposed merger with Peninsula Federal Credit Union. This merger represents a strategic partnership between two forward thinking credit unions for the benefit of members, employees, and the communities we serve.

A merger between Torch Lake Federal Credit Union and Peninsula Federal Credit Union allows us to provide a greater member impact and value through:

Through this partnership our field of membership expands, and we can serve more people and communities throughout Upper Michigan and Northeastern Wisconsin. Together we will have 4 branch locations to serve our members.

- Expanded Products/Services:

Through this partnership, members will gain access to expanded products and services. A few examples of those are:

-

- Access to more competitive deposit and loan rates.

- Additional products and services, such as Mortgages, IRAs (Individual Retirement Accounts), Money Markets, etc.

- Digital enhancements including access to mobile texting and chat features.

- An electronic banking upgrade, giving you enhanced accessibility with improved reliability and convenience and access to see your most current credit score.

- Push Notifications, giving you a more tailored banking experience with advanced security to ensure your banking information remains safe.

- Access to Peninsula Federal Credit Union’s after hours call center, making the ability to do business with us when you need it even more convenient.

- Enhanced Member Experience:

Through streamlined processes, expanded products/service offerings, and innovative digital solutions, we will enhance member satisfaction and loyalty. By leveraging the strength of both credit unions and reducing our costs, we will provide an unparalleled level of service, convenience and return more value in the form of products, service, and community involvement to existing and future members.

As community-based financial institutions, we are committed to making a positive impact on the communities we serve. Through combined resources and expanded outreach programs, we will strengthen our ability to support local initiatives, promote financial literacy, and foster economic growth throughout Michigan counties.

Combining our organizations, positions us with greater financial strength and stability. By joining forces with PFCU, members will benefit from a stronger institution with increased capital reserves and robust risk management practices, providing greater peace of mind and security for their deposits.

- More Responsive to Evolving Financial Needs:

This partnership positions the credit union to better anticipate and meet the financial needs of members in a competitive financial services industry.

- Enhanced Digital Banking Products:

Together we will be able to constantly assess and improve our technology solutions and make sure we’re providing “the best” digital banking we can for members now and into the future.

- Same Knowledgeable, Friendly Employees:

The same friendly staff at Torch Lake Federal Credit Union will continue to serve you.

No. On the date of conversion, members of Torch Lake Federal Credit Union in good standing will become members of Peninsula Federal Credit Union.

There is no effect to your account or account numbers at this time. Eventually, members will convert to PFCU’s core operating systems to enhance capabilities. As that time approaches, the credit union will work to ensure a seamless integration, and communicate important dates, changes, and next steps to ensure members can continue to conduct business with minimal disruption.

The rates on fixed-rate loans and certificates will remain the same until the end of their existing terms. Other products will adjust as normal due to market conditions.

Yes. Credit Union deposits will continue to be federally insured by the NCUA, meaning you have up to $250,000 in protection for an individual account. The NCUA provides separate insurance coverage for deposits held in different ownership categories such as individual accounts, joint tenancy accounts, and Individual Retirement Accounts (IRAs). PFCU also has Excess Share Insurance (ESI) which covers up to $1,000,000. ESI is exclusive to Credit Unions and PFCU is currently the only credit union in the Upper Peninsula offering this protection to qualified member accounts.

Yes. Both organizations are committed to providing high levels of service for members and this will continue to be a focus for the combined organization.

No. Both credit unions recognize the importance of retaining talented and dedicated employees and a successful merger is dependent on that talent and leadership.

As an organization grows, so does its workforce. We believe our ability to invest in the success of our people will expand as opportunities for professional growth and development increase. The member-facing staff in the locations you visit will remain in those locations unless they decide to explore a new opportunity.

At this time there are no plans for any branch closures. In fact, this merger will provide an opportunity to expand our branch locations and enhance our digital member experience. Peninsula Federal Credit Union locations will not be immediately available to Torch Lake Federal Credit Union members and vice versa. As the merger progresses, we will announce when these locations will be available for members.

Questions?

If you have any questions or concerns that are not addressed in the FAQs above, please email marketing@peninsulafcu.com.

About Us

About Peninsula Federal Credit Union

Peninsula Federal Credit Union is a $328 million financial cooperative headquartered in Escanaba, Michigan. Established in 1941 as the credit union for employees of Escanaba Paper Company and their families. Today, PFCU serves over 15,000 members across the Upper Peninsula and Northeast Wisconsin. PFCU has a proud legacy of serving members with low or no cost financial services, cutting edge technology and plays an integral part of the communities they serve. With three branches in Escanaba and Menominee, Michigan, members have additional access through the mobile app as well as more than 5,600 branches in a shared CO-OP network plus over 30,000 surcharge-free ATMs nationwide. Federally insured by NCUA. Equal Housing Lender.

Peninsula Federal Credit Union is a $328 million financial cooperative headquartered in Escanaba, Michigan. Established in 1941 as the credit union for employees of Escanaba Paper Company and their families. Today, PFCU serves over 15,000 members across the Upper Peninsula and Northeast Wisconsin. PFCU has a proud legacy of serving members with low or no cost financial services, cutting edge technology and plays an integral part of the communities they serve. With three branches in Escanaba and Menominee, Michigan, members have additional access through the mobile app as well as more than 5,600 branches in a shared CO-OP network plus over 30,000 surcharge-free ATMs nationwide. Federally insured by NCUA. Equal Housing Lender.

About Torch Lake Federal Credit Union

Torch Lake Federal Credit Union is a $11 million financial cooperative headquartered in Laurium, Michigan. Established in 1955, in Lake Linden to offer financial services to the members of the Knights of Columbus Torch Lakes Council #2713, employees of the credit union and their families. Today, Torch Lake Federal Credit Union serves over 1,600 members from Dollar Bay north to Copper Harbor. Torch Lake Federal CU is focused on providing new financial services in an ever-changing market and their members are the heart & soul of the credit union. Federally insured by NCUA. Equal Housing Lender. For additional information visit, torchlakefederal.com.

Torch Lake Federal Credit Union is a $11 million financial cooperative headquartered in Laurium, Michigan. Established in 1955, in Lake Linden to offer financial services to the members of the Knights of Columbus Torch Lakes Council #2713, employees of the credit union and their families. Today, Torch Lake Federal Credit Union serves over 1,600 members from Dollar Bay north to Copper Harbor. Torch Lake Federal CU is focused on providing new financial services in an ever-changing market and their members are the heart & soul of the credit union. Federally insured by NCUA. Equal Housing Lender. For additional information visit, torchlakefederal.com.

Peninsula Federal Credit Union is a $328 million financial cooperative headquartered in Escanaba, Michigan. Established in 1941 as the credit union for employees of Escanaba Paper Company and their families. Today, PFCU serves over 15,000 members across the Upper Peninsula and Northeast Wisconsin. PFCU has a proud legacy of serving members with low or no cost financial services, cutting edge technology and plays an integral part of the communities they serve. With three branches in Escanaba and Menominee, Michigan, members have additional access through the mobile app as well as more than 5,600 branches in a shared CO-OP network plus over 30,000 surcharge-free ATMs nationwide. Federally insured by NCUA. Equal Housing Lender.

Peninsula Federal Credit Union is a $328 million financial cooperative headquartered in Escanaba, Michigan. Established in 1941 as the credit union for employees of Escanaba Paper Company and their families. Today, PFCU serves over 15,000 members across the Upper Peninsula and Northeast Wisconsin. PFCU has a proud legacy of serving members with low or no cost financial services, cutting edge technology and plays an integral part of the communities they serve. With three branches in Escanaba and Menominee, Michigan, members have additional access through the mobile app as well as more than 5,600 branches in a shared CO-OP network plus over 30,000 surcharge-free ATMs nationwide. Federally insured by NCUA. Equal Housing Lender. Torch Lake Federal Credit Union is a $11 million financial cooperative headquartered in Laurium, Michigan. Established in 1955, in Lake Linden to offer financial services to the members of the Knights of Columbus Torch Lakes Council #2713, employees of the credit union and their families. Today, Torch Lake Federal Credit Union serves over 1,600 members from Dollar Bay north to Copper Harbor. Torch Lake Federal CU is focused on providing new financial services in an ever-changing market and their members are the heart & soul of the credit union. Federally insured by NCUA. Equal Housing Lender. For additional information visit, torchlakefederal.com.

Torch Lake Federal Credit Union is a $11 million financial cooperative headquartered in Laurium, Michigan. Established in 1955, in Lake Linden to offer financial services to the members of the Knights of Columbus Torch Lakes Council #2713, employees of the credit union and their families. Today, Torch Lake Federal Credit Union serves over 1,600 members from Dollar Bay north to Copper Harbor. Torch Lake Federal CU is focused on providing new financial services in an ever-changing market and their members are the heart & soul of the credit union. Federally insured by NCUA. Equal Housing Lender. For additional information visit, torchlakefederal.com.